Understanding UPI

Unified Payments Interface (UPI) is a real-time payment system in India that allows for instant money transfer between two bank accounts on a mobile platform. It’s revolutionized the way we transact, making payments seamless and secure.

Key Components of UPI

- Virtual Payment Address (VPA): This is a unique identifier linked to your bank account, typically in the format “yourname@bankname”.

- UPI ID: This is a combination of your mobile number and the name of the UPI app you’re using, e.g., 9876543210@paytm.

- UPI PIN: A four or six-digit PIN for authorizing transactions.

How a UPI Transaction Works

- Initiation:

- You use a UPI-enabled app to initiate a transaction.

- You enter the recipient’s VPA, UPI ID, or mobile number.

- Specify the amount to be transferred.

- Authentication:

- The app verifies the recipient’s details.

- You enter your UPI PIN to authorize the transaction.

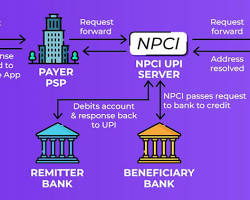

- Transaction Processing:

- The transaction request is sent to the Payment Service Provider (PSP) associated with your bank.

- The PSP forwards the request to the National Payments Corporation of India (NPCI), which operates UPI.

- NPCI routes the request to the sender’s and recipient’s banks.

- Fund Transfer:

- The sender’s bank verifies the account balance and authorizes the transaction.

- Funds are transferred from the sender’s account to the recipient’s account in real-time.

- Confirmation:

- Both sender and recipient receive transaction confirmation messages.

Behind the Scenes: The Role of Banks and NPCI

- Banks: Participate as member banks and provide UPI services to their customers. They handle fund transfers, account verification, and fraud prevention.

- NPCI: Oversees the UPI system, manages the network, and ensures interoperability between different banks and apps.

Security Measures in UPI

- Two-factor authentication: Requires both the UPI PIN and mobile device for authorization.

- Virtual addresses: Protect sensitive bank account details.

- Robust fraud detection systems: Monitor transactions for suspicious activity.

Benefits of UPI

- Real-time transfers: Instantaneous money movement.

- Convenience: Easy to use with a single interface.

- Security: Multiple layers of protection.

- Cost-effective: Lower transaction charges compared to traditional methods.

- Inclusivity: Accessible to a wide range of users.

Challenges and Future of UPI

While UPI has been a game-changer, challenges like internet connectivity issues and security threats persist. The future of UPI lies in expanding its reach to rural areas, integrating with more services (e.g., bill payments, insurance), and enhancing security measures.

In conclusion, UPI has transformed the payment landscape in India, offering speed, convenience, and security. As technology evolves, we can expect UPI to become even more integrated into our daily lives.